"There are serious concerns about transparency and accountability...confusion about the goals of the program, and a deep skepticism about whether we are using the taxpayers' money wisely."

Secretary nominee Timothy Geithner, testifying Wednesday at his Senate confirmation hearing, acknowledged.

Bankers, regulators and politicians complain of a secretive and opaque process for deciding which banks get cash and which don't.

Part of the problem is that some powerful politicians have used their leverage to try to direct federal millions toward banks in their home states.

"It's totally arbitrary," says South Carolina Gov. Mark Sanford.

"If you've got the right lobbyist and the right representative connected to Washington or the right ties to Washington, you get the golden tap --the government bailout money handout-- on the shoulder," says Gov. Sanford, a Republican.

http://online.wsj.com/article/SB123258284337504295.htmlOhio banks are now faring better.

Twelve Ohio banks have subsequently received a total of $7.7 billion in taxpayer funds.

In neighboring Michigan -- like Ohio, hurt by the auto-industry slump -- only two banks have had federal infusions and a third has preliminary approval, for infusions totaling $638 million.

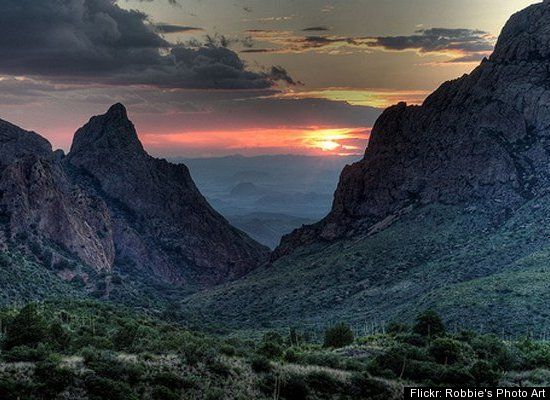

Two banks in Green Bay, Wis., have received federal investments. But in Arizona, a state hit hard by the housing slump, officials say they are perplexed that a dozen or so state-chartered banks haven't heard back from Treasury about the status of their applications.

Real estate loans

Five Alabama banks, including Colonial, are slated to collect a total of about $4.2 billion.

In addition to Rep. Bachus, Alabama, Alabama Sen. Richard Shelby, the ranking Republican on the Senate Banking Committee, "has been a big proponent for Alabama state-chartered banks.